- The traditional 60-40 stock-bond portfolio is losing efficacy as inflation pressures mount, says JPMorgan Asset Management.

- Top strategists at the firm shared four alternatives for driving income.

- They also explained why bitcoin doesn’t have a place in such traditional portfolios.

The pandemic disrupted the global economy and upended industries like travel and commercial real estate. Now, according to top strategists at JPMorgan Asset Management, it may soon claim another victim: the traditional 60-40 stock-bond portfolio.

In projections made after the global financial crisis, JPMorgan found that a 60-40 portfolio of US stocks and bonds delivered a 7.5% return with expected volatility of 8.3%. Now the return has been nearly cut in half to 4.3% – but volatility is even higher, at 9.7%.

That erosion has been hastened by inflationary pressures brought on by prolonged monetary accommodation in response to the pandemic. JPMorgan says the surge in inflation has torpedoed real, inflation-adjusted Treasury yields to near zero, dragging on a significant portion of the 60-40 portfolio.

“There’s no getting away from it: A world where we’ve got relatively easy policy and a little bit more upside risk to inflation [means] real yields are going to suffer,” said John Bilton, the head of global multi-asset strategy for JPMAM, in a November 8 webinar, hours after the LTCMA report was released.

Investment alternatives

JPMorgan says getting creative and finding other income streams will serve investors well in the next 10 to 15 years in the event that bond yields stay suppressed.

"If we're looking for using bonds for managing liabilities, they still have a job to do; they still diversify a portfolio," Bilton said on the webinar. "But what they won't do, realistically, is offer an income stream. And so that balance we had in portfolios in that 40% much of the last quarter-century is going to be much harder to find. It means we need to rethink that stock-bond barbell."

According to JPMorgan, the following four areas offer good alternative sources of income: extended fixed income, real estate, equity dividends, and infrastructure.

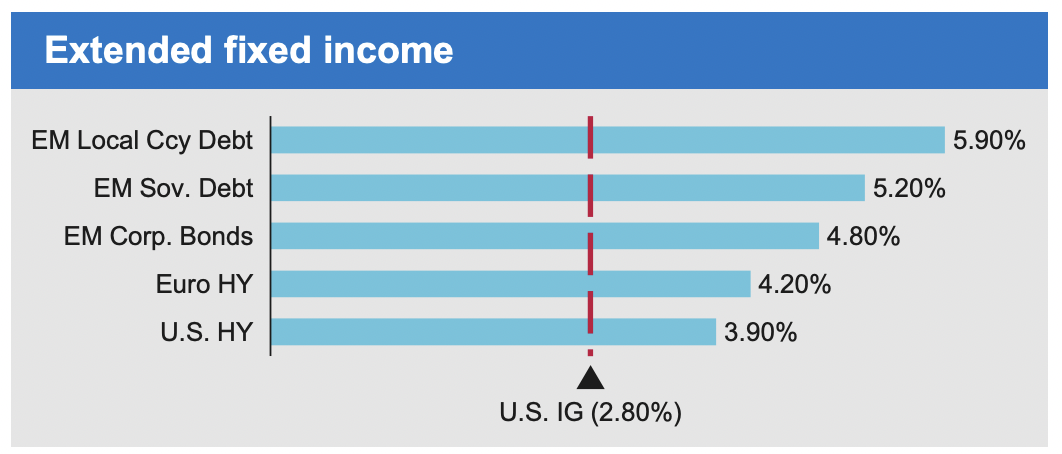

Within the extended fixed income space, JPMorgan recommends emerging-market corporate bonds, sovereign debt, and local-currency bonds. It also notes that both European and US high-yield debt will provide significantly higher returns that their US investment-grade counterparts. As the chart below shows, there is significant additional income available for investors with higher risk tolerance.

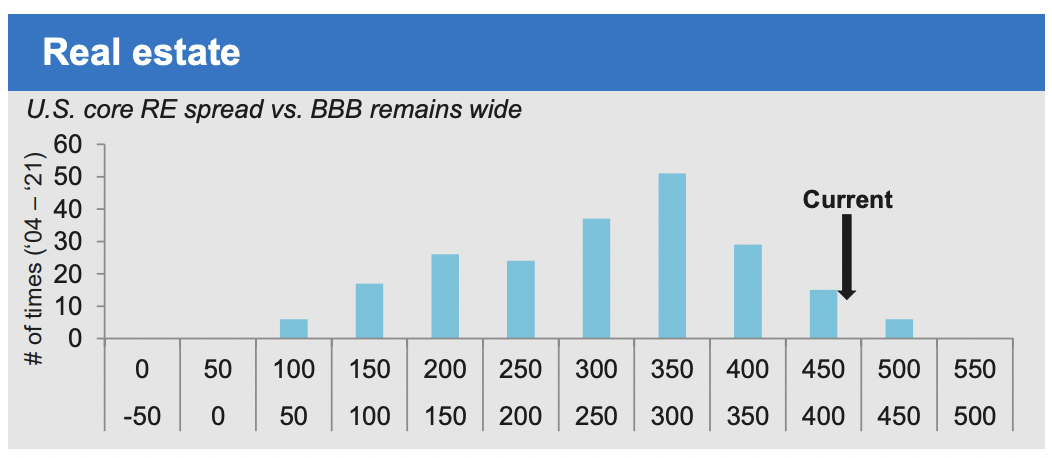

Secondly, the spread between US core real estate and BBB-rated bonds - or those that reside on the lowest rung of investment grade - is uncommonly wide, based on JPMorgan data going back to 2004. Reflected in the chart below, Bilton says that means there's "good income" in the sector relative to the bond-market alternative.

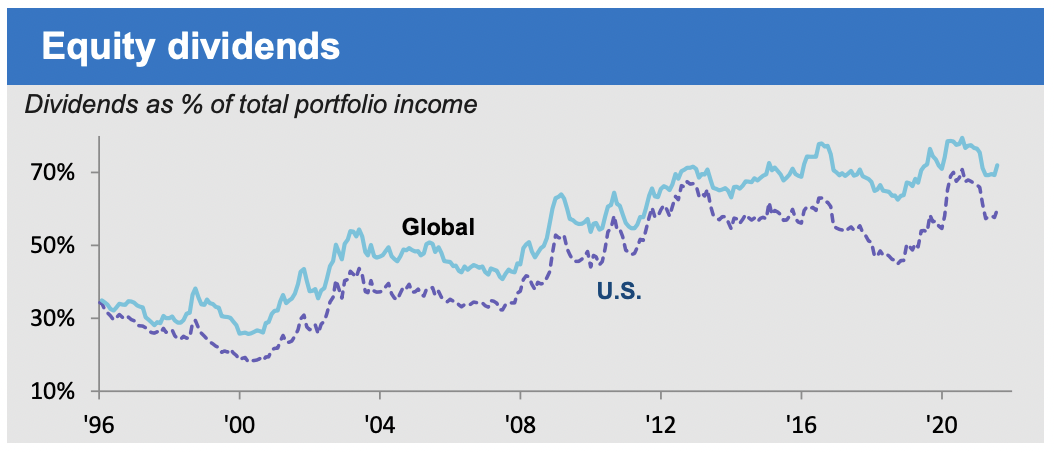

Third, high cash levels on corporate balance sheets should result in bigger stock dividends for both US and ex-US stocks, Bilton said. As such, he advises investors to supplement their portfolios with more stocks that pay hefty regular dividends. The chart below - which shows dividends contributing an increasing percentage to total portfolio income - supports the idea that more exposure to such stocks is additive.

Finally, Bilton highlights infrastructure names as offering consistent annualized income of roughly 5%, which he says far exceeds what bonds can offer if inflation settles near JPMorgan's target of 2.4%.

"There are not many asset classes out there that also have some level of inflation protection which are going to be able to offer that type of return in income terms," Bilton said.

The case against adding bitcoin

Bitcoin's gravity-defying run since late 2020, driven in part by a flood of institutional money into the world's biggest cryptocurrency, has many investors wondering if it belongs in their portfolio.

David Kelly, JPMAM's chief global strategist, says no.

Before investing, portfolio managers must consider an asset's expected return, volatility, and correlation with other assets, Kelly said. With all of that in mind, bitcoin is "unlikely to be a good portfolio asset," Kelly said on the webinar.

First, despite the runaway success of many crypto investors and market technicians, Kelly said it's "extremely difficult to come up with any logical framework" to project future moves of bitcoin or other digital assets.

JPMorgan also highlighted the highly volatile nature of bitcoin. The coin is a "quantum leap higher" from a volatility standpoint when compared to stocks and other risk assets, Kelly said on the webinar.

Lastly, portfolio managers must consider whether bitcoin, despite its high volatility, could make a portfolio less volatile because of its low correlation to other assets. This hasn't proven to be true with bitcoin, Kelly said, given that the asset increased a portfolio's beta, or systematic risk profile.

Overall, while the firm's projections show a 2.5% bitcoin allocation is likely to give a portfolio more upside, the corresponding increase in risk isn't worth it, Kelly wrote.

Despite their skepticism, JPMorgan did do the math around the breakeven point for annualized bitcoin returns that would make it worth including in a portfolio.

"An annualized return of 33% - or 316% over five years - would be needed to maintain the portfolio's Sharpe ratio [risk-reward profile] and for the investment to be considered an appropriate use of the risk budget," Kelly wrote.